north dakota sales tax refund

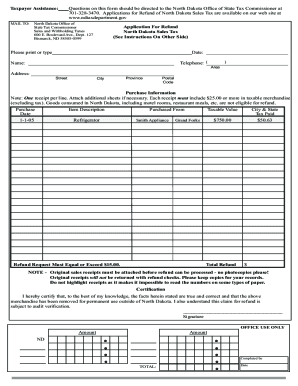

To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be removed from North Dakota within 30 days of purchase for use permanently outside of North Dakota. Refunds Things to Know.

Form 40 Qr 28755 Download Fillable Pdf Or Fill Online Application For Quick Refund Of Overpayment Of Estimated Income Tax For Corporations North Dakota Templateroller

Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

. North Dakota sales tax payments. Emergency medical services operations may obtain a full refund for. Canadian residents may obtain a refund of North Dakota sales tax paid on qualifying purchases those purchased to be used exclusively outside the state.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021. Updates are posted 60 days prior to the changes becoming effective. Written Determinations Sales and Use Tax.

New mobile homes at 3. This allows you to file and pay both your federal and North Dakota income tax return at the same time. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US.

Consumers who use motor vehicle fuel for an industrial purpose may obtain a partial refund of 22½ cents per gallon. Ndgov Cory Fong Tax Commissioner NNoticeotice Sales Tax Request For Refund - Canadian Resident May 5 2009 In recent months the Tax Department has received a considerable number of sales tax refund. The state sales tax rate in North Dakota is 5000.

Sales and Use Tax Revenue Law. With local taxes the total sales tax rate is between 5000 and 8500. Refund Applied to Debt North Dakota participates in income tax refund offset which provides that an individual income tax must be applied to reduce a debt you may owe to a state or federal agency.

Gross receipts tax is applied to sales of. E-Filing Free Filing. Form 301-EF - ACH Credit Authorization.

Varo Money - Wikipedia. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program. Quick guide on how to complete north dakota sales tax refund claim form.

127 Bismarck ND 58505-0599. You can lookup North Dakota city and county sales. The deadline for applying for North Dakotas gas tax refund is fast approaching.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Seller collects sales tax for items posted to the following states. Taxable sales and purchases for January February and March of 2022 were 47 billion.

Amended Returns and Refund Claims. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of 596 when combined with the state sales tax. Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

North Carolina Department of Revenue. You can receive the refund if 20 of your. New farm machinery used exclusively for agriculture production at 3.

How to File Sales and Use Tax Resources. Taxable purchases must be a least 25 per receipt and the refund request must be at least 15. State Sales tax rate.

Goods consumed in North Dakota including hotel rooms and dining are not eligible for a refund. Furthermore refunds are available only on taxable purchases of 2500 or more. The refund is available for individuals only not businesses on real goods that are used.

North Dakota Sales Tax. The claim for refund must include copies of all invoices to support the claim. Shoppers from bordering provinces Manitoba or Saskatchewan or anywhere else in Canada for that matter might be eligible for a refund of the state sales tax they paid on purchase while visiting North Dakota.

This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax. North Dakota sales tax is comprised of 2 parts. Forget about scanning and printing out forms.

PO Box 25000 Raleigh NC. North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on top of the state tax. SignNows web-based service is specially created to simplify the arrangement of workflow and optimize the whole process of competent document management.

North Dakota has recent rate changes Thu Jul 01 2021. The maximum local tax rate allowed by North Dakota law is 3. Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes.

North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. Localities can add as much as 35 and the average combined rate is 696 according to the Tax Foundation. How can we make this page better for you.

The Bismarck Tribune reports that June 30 is. A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E. State and political subdivisions may obtain a full refund for all motor vehicle fuel used for construction reconstruction and maintenance of roads and highways.

The Cost of a Varo Virtual Debit. Select the North Dakota city from the list of popular cities below to see its current sales tax rate. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

Up until October 1 2020. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. Thursday June 23 2022 - 0900 am.

North Dakota tax officials sure know how to be good neighbors. Form 306 - Income Tax Withholding Return. Use our detailed instructions to fill out and eSign your documents online.

New local taxes and changes to existing local taxes become effective on the first day of a calendar quarter. Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. Local Taxes City or County Taxes Cities and counties may.

No matter what method you use to file tax preparer software you purchase or one of the Free-File options here. North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD.

How To File And Pay Sales Tax In North Dakota Taxvalet

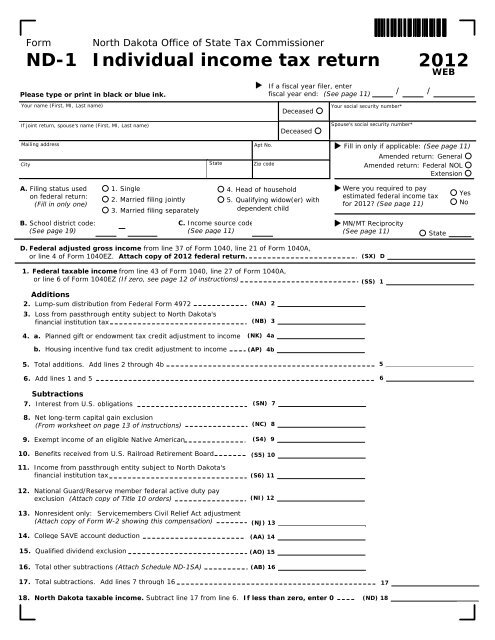

North Dakota Tax Forms And Instructions For 2021 Form Nd 1

Ndtax Department Ndtaxdepartment Twitter

North Dakota Tax Refund Canada Fill Online Printable Fillable Blank Pdffiller

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

Nd Form St 2016 2022 Fill Out Tax Template Online Us Legal Forms

Where S My Refund Of North Dakota Taxes

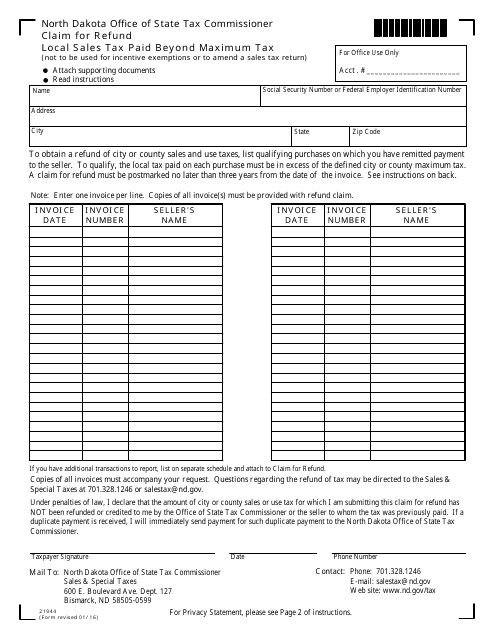

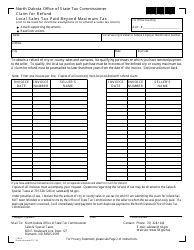

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Tax Refund Canada Form Fill Out And Sign Printable Pdf Template Signnow

Form Nd 1 Individual Income Tax Return State Of North Dakota

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Contractors Be Sure To Get Your Dor Supplies Before You Begin Your Project South Dakota Department Of Revenue

Where S My Refund North Dakota H R Block

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

Ndtax Department Ndtaxdepartment Twitter

North Dakota Nd State Tax Refund Tax Brackets Taxact

/cloudfront-us-east-1.images.arcpublishing.com/gray/QU6AHKTDPFKBFGKQGGGUVF5UEU.jpg)

Sales And Property Tax Refund Program Open To Senior Citizens And Citizens With Disabilities

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller